CIBIL Score Kaise Check Kare 2026 आने में अब सिर्फ 10 दिन बचे हैं, और अगर आप New Year में Home Loan, Personal Loan, Business Loan या Credit Card लेने की planning कर रहे हैं, तो सबसे पहला काम होना चाहिए – apna CIBIL Score check karna।

2026 में banks और NBFCs पहले से ज्यादा strict credit policy follow कर रही हैं। Low CIBIL Score होने पर loan rejection के chances बढ़ गए हैं, वहीं 750+ credit score वालों को fast approval और low interest rate मिल रहा है।

इस article में हम detail में जानेंगे:

- CIBIL Score kya hota hai

- CIBIL Score free me kaise check kare 2026

- Credit Score kharab kyun hota hai

- 900 tak CIBIL Score badhane ke best tarike

- Loan approval me CIBIL Score ka role

🔍 CIBIL Score Kya Hota Hai? (What is Credit Score)

CIBIL Score ek 3-digit number hota hai jo aapki credit history aur repayment behaviour ko show karta hai।

Ye score 300 se 900 ke beech hota hai।

India me sabse popular credit bureau hai TransUnion CIBIL, jo banks aur finance companies ko aapka credit data provide karta hai।

CIBIL Score mainly in factors par depend karta hai:

- Loan & EMI repayment history

- Credit card usage

- Total loan amount

- Payment discipline

📊 CIBIL Score Range aur Meaning (2026 Updated)

| Credit Score | Status | Meaning |

|---|---|---|

| 750 – 900 | Excellent | Loan easily approve |

| 700 – 749 | Good | Normal approval |

| 650 – 699 | Average | Higher interest |

| 550 – 649 | Poor | Risky profile |

| Below 550 | Very Poor | Loan reject chances high |

👉 2026 me minimum 750+ score hone par hi best loan offers mil rahe hain।

🆓 CIBIL Score Free Me Kaise Check Kare 2026?

2026 me aap credit score free me online multiple ways se check kar sakte hain, bina kisi charge ke।

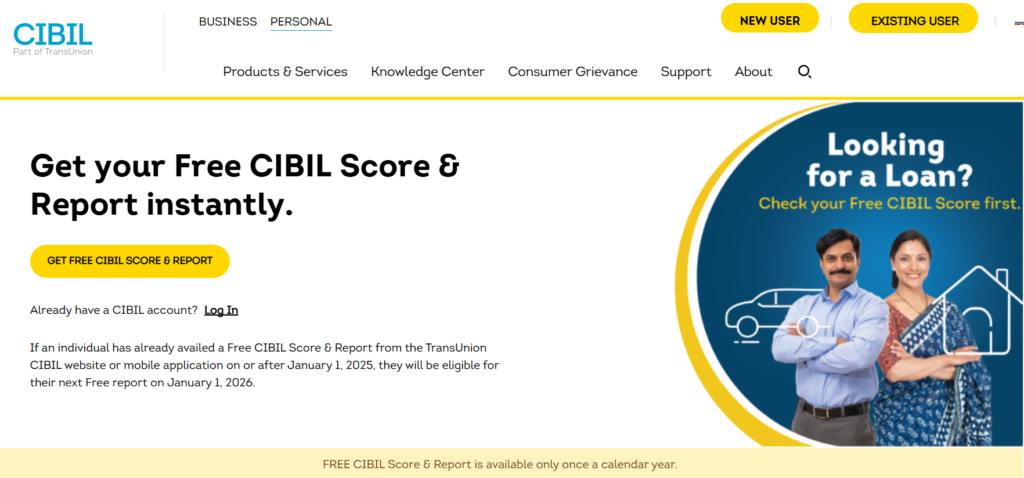

✅ Method 1: Official Credit Bureau Website

- Year me 1 free credit report

- PAN Card + Mobile Number required

✅ Method 2: Bank & Finance Apps

Kai reputed bank aur finance apps:

- Free credit score show karte hain

- Score check karne se score kam nahi hota

- Regular update milta hai

✅ Method 3: Net Banking / Credit Card Account

Agar aapke paas:

- Bank account

- Credit card

to net banking login karke Credit Score section me free score dekh sakte hain।

👉 Important: Credit score dekhna “soft enquiry” hota hai, isse score par koi negative effect nahi padta।

❌ 2026 Me CIBIL Score Low Kyun Hota Hai?

Bahut log 2026 ke start me ye problem face karte hain ki:

“Loan apply karte hi reject ho jata hai”

Iske main reasons ye ho sakte hain:

🔻 1. EMI ya Credit Card Late Payment

- Due date miss karna

- Minimum amount bhi time par na dena

👉 Sabse bada negative factor

🔻 2. Credit Limit Ka Overuse

- 80–90% credit limit use karna

- High credit utilization ratio

🔻 3. Multiple Loan / Card Apply Karna

- Short time me baar-baar apply

- Hard enquiries badhti hain

🔻 4. Old Loan Default / Settlement

- Personal loan default

- Credit card outstanding

- Settlement status

🚀 900 Tak CIBIL Score Kaise Badhaye? (2026 Proven Strategy)

Ab sabse important part 👇

Agar aap 2026 me apna credit score improve karna chahte hain, to ye steps follow karein।

✅ 1️⃣ EMI aur Credit Card Bill Time Par Pay Karein

- Due date se pehle payment

- Auto-debit enable karein

👉 Ye step alone score ko kaafi improve karta hai।

✅ 2️⃣ Credit Utilization 30% Se Kam Rakhein

Example:

- Credit limit: ₹1,00,000

- Safe usage: ₹30,000 se kam

👉 Low usage = High score

✅ 3️⃣ Purana Credit Card Band Na Karein

- Old card = long credit history

- Credit age badhti hai

👉 Score naturally boost hota hai।

✅ 4️⃣ Unnecessary Loan Apply Karna Band Karein

- Har hard enquiry score girati hai

- Sirf genuine need par apply karein

✅ 5️⃣ Small Loan Strategy (Low Score Walo Ke Liye)

Agar score bahut low hai:

- Small personal loan ya consumer loan lein

- 6–12 months tak EMI time par pay karein

👉 Credit history rebuild hoti hai।

✅ 6️⃣ Credit Report Me Galti Ho To Dispute Karein

Kai baar report me:

- Closed loan active dikh jata hai

- Duplicate entry hoti hai

👉 Dispute raise karke correct karwana zaroori hai।

⏳ CIBIL Score Improve Hone Me Kitna Time Lagta Hai?

| Situation | Time |

|---|---|

| 1–2 late payments | 2–3 months |

| Multiple delays | 6–9 months |

| Default / settlement | 12–24 months |

👉 Consistency sabse important hai।

🏦 2026 Me Loan Approval Ke Liye CIBIL Score Kyun Zaroori Hai?

2026 me banks:

- Risk kam lena chahti hain

- Digital credit profiling use kar rahi hain

High CIBIL Score hone par:

- Loan fast approve

- Interest rate kam

- Higher loan amount

Low score hone par:

- Reject ya high interest

❓ FAQs – CIBIL Score 2026

Q1. CIBIL Score free me kitni baar check kar sakte hain?

👉 Apps par multiple times, official report yearly free.

Q2. Credit score check karne se score kam hota hai?

👉 ❌ Nahi, soft enquiry hoti hai।

Q3. 2026 me loan ke liye minimum CIBIL Score kya hai?

👉 Minimum 650+, best 750+.

Q4. Kya 1 month me score badh sakta hai?

👉 Thoda improvement possible hai, big jump me time lagta hai।

Q5. Zero credit history wale kya karein?

👉 Starter credit card ya small loan lein।

Related Post

- KCC AHD Loan 2026: पशुपालन और Dairy Farmers के लिए ₹2 लाख तक Kisan Credit

- Flipkart Axis Bank Credit Card Apply 2025 – Cashback, Eligibility, Fees, Benefits &

- Mudra Loan 2025 – बिना गारंटी ₹10 लाख तक का सरकारी लोन | Apply Online Now |

- PNB Credit Card 2025 – Types, Benefits, Eligibility, Fees, Apply Online now

🔚 Conclusion (2026 Final)

2026 start hone se pehle, agar aap apni financial life secure karna chahte hain, to aaj hi apna CIBIL Score check karein।

Discipline, timely payment aur smart credit usage se aap bhi 900 tak credit score achieve kar sakte hain।

👉 Yaad rakhiye:

Good CIBIL Score = Easy Loan + Low Interest + Financial Freedom